postmates tax form online

If youre sending a tax return for the 2017 to 2018 tax year or earlier get forms from the National Archives. Postmates tax form online Saturday March 19 2022 Edit.

The Ultimate Guide To Taxes For Postmates Stride Blog

Postmates is a great way to make money in 2021 especially if you have a car however with tax season coming up theres one thing you must know when it com.

. The IRS 1099 form is the one that Postmates -- or any other company that has a contract with freelancers or self-employed people -- will send to them. Or do I need to just get it from my account. This is what they said.

At this time 2021 1099-Forms are not available. We answer all your Postmates tax questions and cover the most common deductions you can get here. IRS Tax Forms For A Postmates Independent Contractor.

This means that if you work for Postmates you have to track your own taxes. It is also sometimes referred to as a. Hi if u have received.

Home form online postmates tax. IRS Tax Forms For A Postmates Independent Contractor. If youve gotten your 1099 from Postmates then its time to fill out.

Since Postmates has been acquired by Uber youll need to reach out to Uber for your 1099. Look for the tax information tab. Will Postmates send a 1099 to our email.

According to postmates if you dont meet this requirement. How To Get Postmates Tax 1099 Forms Youtube Postmates Taxes The. Hi if u have received 1099 from Postmates what was their email address that they sent it.

How To Get Postmates Tax 1099 Forms_____New Project. Posted by 1 year ago. Sign in to file your tax.

Postmates Tax Form Online Your Earnings Exceed 600 In A Year. As a Postmates delivery driver youll receive a 1099 form. You can make many deductions through your work effectively reducing your.

As 1099-NEC forms provide annual income and the tax year is not completed yet the form has not been created at. The types of 1099 forms drivers usually are based on a few factors how. In the case of Postmates drivers they will receive the 1099 forms from Uber Uber bought Postmates in 2021.

There Are Many Irs 1099. This means that if you work for Postmates you have to track your own taxes. PostmatesUber Tax Form 1099 Help.

Use commercial software or download other forms instead. A 1099 form is an information return that shows how much you were paid. This is what they said.

While Stride operates separately from Postmates I can. Download the app now to get everything you crave on-demand. Order delivery or pickup from more than 600000 restaurants retailers grocers and more all across your city.

1 online tax filing solution for self-employed. A 1099 form is an information return that shows how much you were paid from a business or client.

How To Cancel A Postmates Order You Ordered Or Scheduled

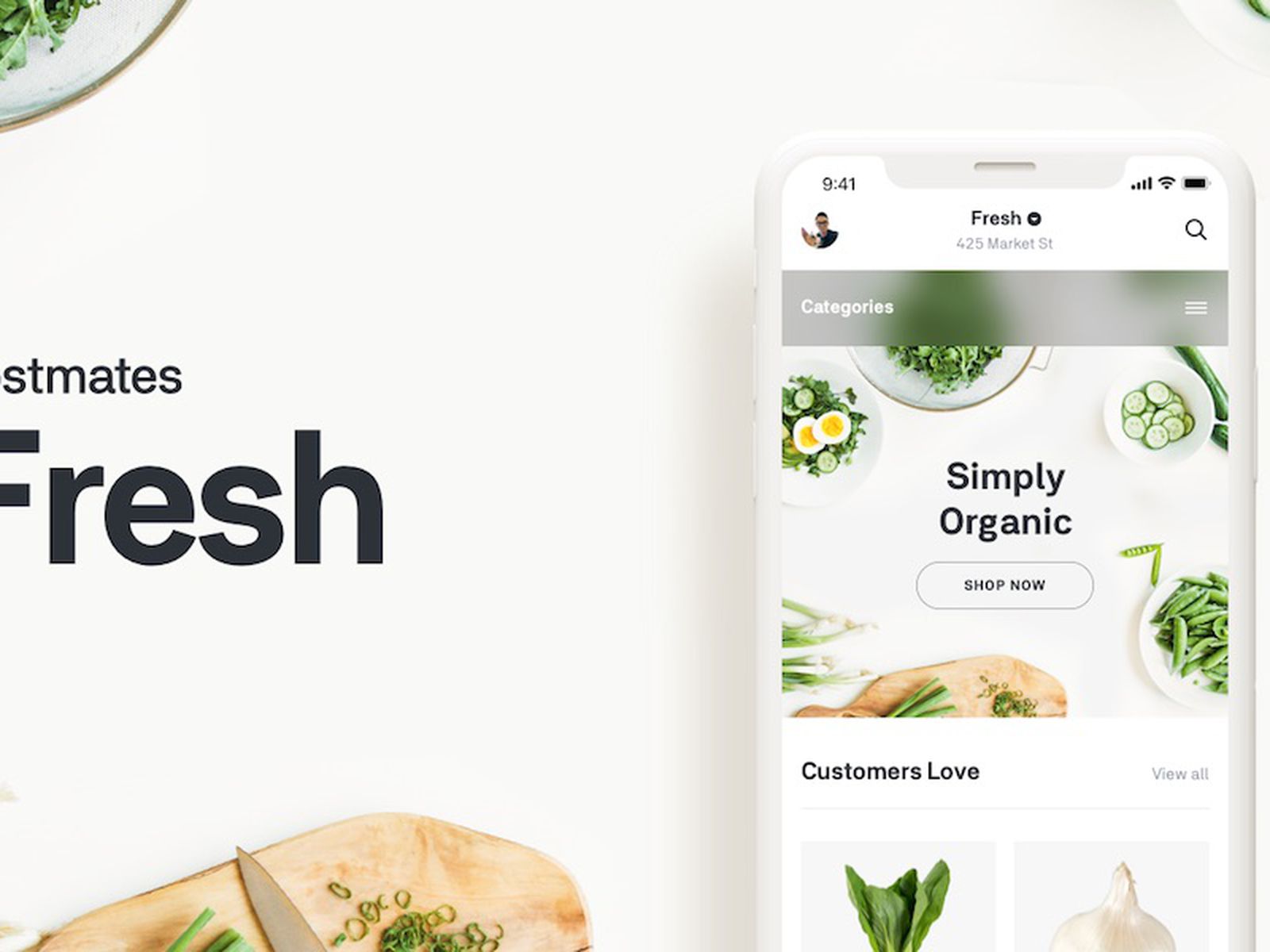

Postmates Announces New Grocery Delivery Service Fresh Alongside Ios App Redesign Updated Macrumors

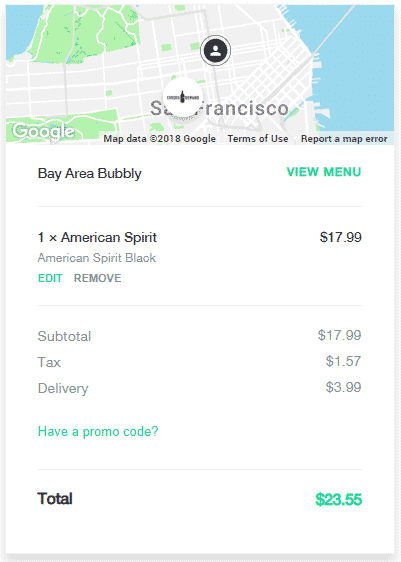

Postmates Class Action Says Anything Anytime Anywhere Is Misleading Top Class Actions

Postmates Ubereats Online Food Ordering Integrations For Restaurants And Caterers Zuppler Zuppler

Postmates Ubereats Online Food Ordering Integrations For Restaurants And Caterers Zuppler Zuppler

Understanding 1099 Forms For Delivery Drivers In The Gig Economy

Drive For Postmates A Complete Guide To Getting Started Ridester Com

Postmates 1099 Taxes The Last Guide You Ll Ever Need

You Made 700 From An Online Side Hustle Now The Irs Will Know Wsj

Is Postmates Worth It Hourly Pay Requirements What To Expect

Postmates Vehicle Car Requirements Complete Guide 2022

Postmates Taxes 101 Filing Postmates Taxes For The End Of The Year Youtube

How Much Are Postmates Drivers Paid Detailed Pay Review

Postmates Taxes The Complete Guide Net Pay Advance

Drive For Postmates A Complete Guide To Getting Started Ridester Com

Doordash 1099 How To Get Your Tax Form And When It S Sent

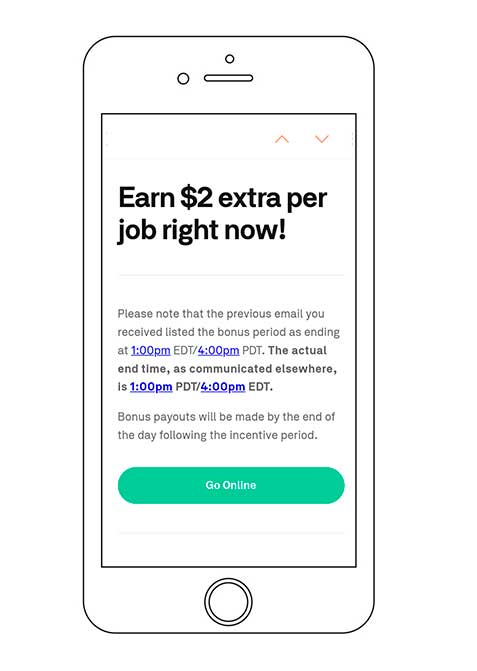

What Is Postmates Paying During The Pandemic Payup

How Does Postmates Work Postmates Business Model Feedough

Postmates Fleet Your Guide To Joining The Delivery Team Ridester Com